How Much Can You Contribute To 529 Plan In 2024

How Much Can You Contribute To 529 Plan In 2024. February 29, 2024 each state sets a maximum 529 plan contribution limit per beneficiary. Be aware that there is a maximum amount of $35,000, as a lifetime limit, that can be rolled from a 529 plan to a roth ira.

Normal roth ira annual contribution limits apply. Americans are getting an average tax refund of $3,109.

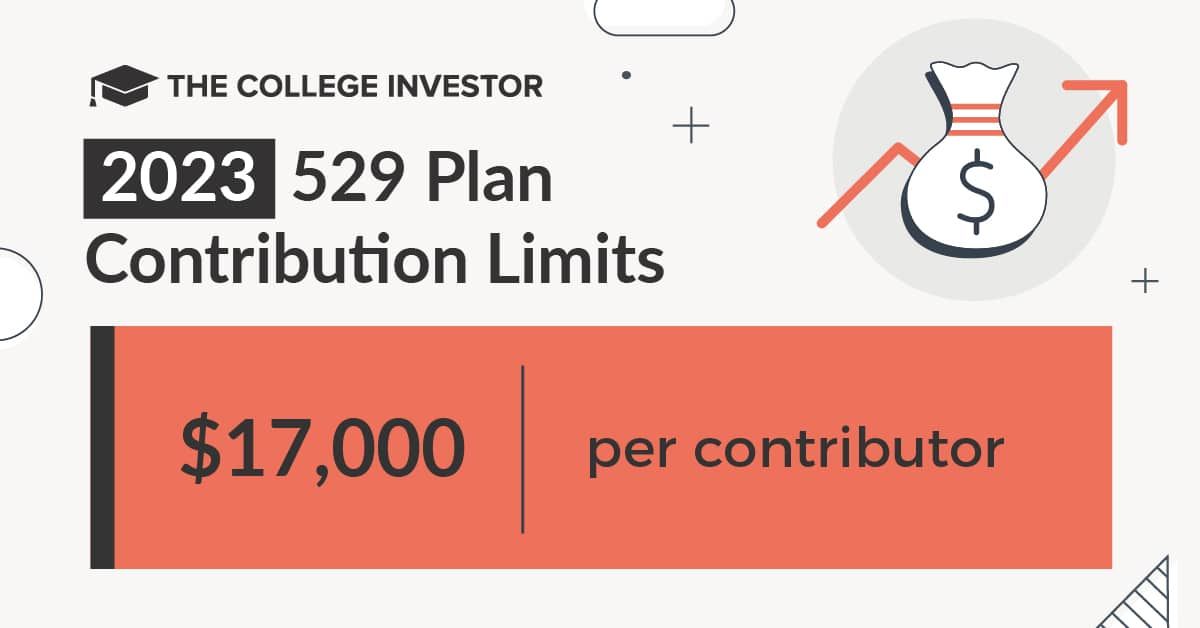

February 29, 2024 Each State Sets A Maximum 529 Plan Contribution Limit Per Beneficiary.

Mar 28, 2024, 9:05 am pdt.

There Are No Limits On How Much You Can Contribute To A 529 Account Each Year.

You can contribute as much as you’d like to a 529 plan per year, but there are some caveats.

Instead, The Amount You Can Contribute Is Maxed Out At A Total.

Images References :

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits (How Much Can You Contribute Every Year, Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states. 529 contribution limits 2024 all you need to know about max 529, “starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

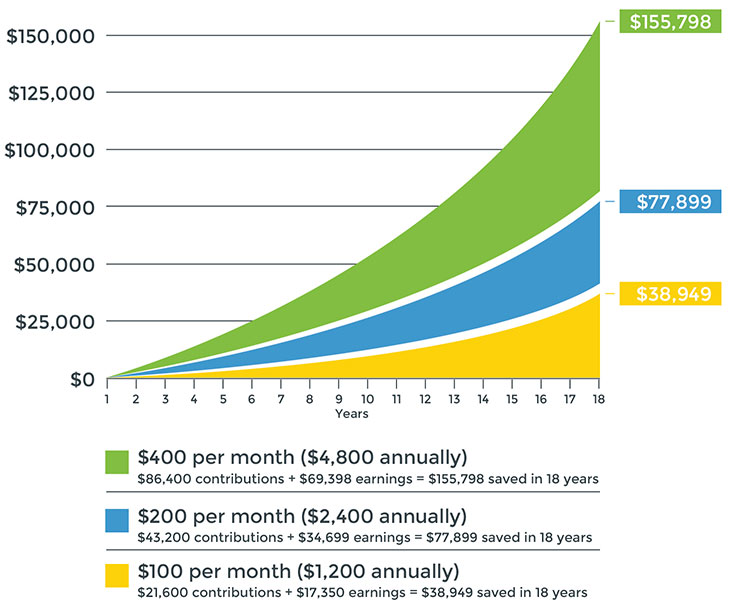

529 Plan Contribution Limits For 2023 And 2024, Here are today's current monthly estimates, according to kantrowitz: How much can i contribute to a 529 plan?

Source: research.com

Source: research.com

How much can you contribute to a 529 plan & what does it cover, A 529 savings plan is an excellent way to save for college. In 2024, the annual gift tax exclusion increased to $18,000 for individuals and $36,000 for married couples.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, 529 contribution limits 2024 all you need to know about max 529, “starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira. Instead, the amount you can contribute is maxed out at a total.

Source: atonce.com

Source: atonce.com

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2024, In addition, you need to have owned the 529 plan for at. Normal roth ira annual contribution limits apply.

Source: nest529direct.com

Source: nest529direct.com

529 Plan Contributions NEST 529 College Savings, 529 contribution limits 2024 all you need to know about max 529, “starting in 2024, the secure 2.0 act allows savers to roll unused 529 funds into the beneficiary’s roth ira. Using money in a 529 plan, you can always leave excess funds in a.

Source: www.iontuition.com

Source: www.iontuition.com

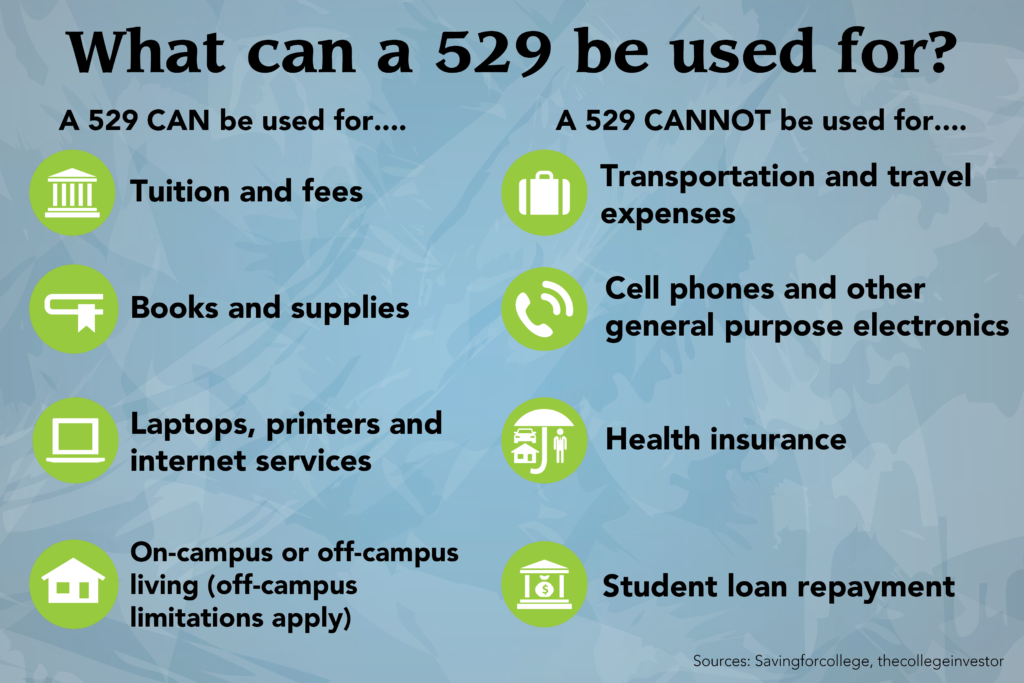

529infographic IonTuition Education Fintech Services, Stacks of cash getty/pm images. Your 529 can be used for student loan repayment up a $10,000 lifetime limit per individual.1.

Source: www.youtube.com

Source: www.youtube.com

529 College Savings Plan How Much Should You Contribute? YouTube, Instead, the amount you can contribute is maxed out at a total. There are no yearly limits to how much you can contribute to a 529 plan.

Source: howtopayforcollege.com

Source: howtopayforcollege.com

How Much Can You Contribute to a 529? — How to Pay for College, A utma has numerous tax advantages for you, as well. The idea of a 529 college savings plan is great:

Source: blog.centralnational.com

Source: blog.centralnational.com

What You Need to Know About 529 Plans CNBconnect, New york 529 plans have one. Most of these rules are pretty straightforward.

The Idea Of A 529 College Savings Plan Is Great:

In 2024, the annual gift tax exclusion increased to $18,000 for individuals and $36,000 for married couples.

How Much Can I Contribute To A 529 Plan?

If you contribute an especially large sum in one year, you may lose eligibility.